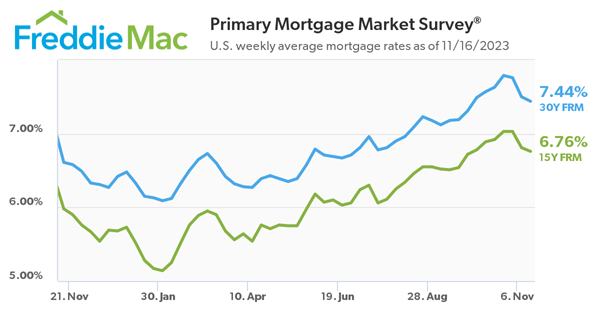

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 7.44 percent.

“For the third straight week, mortgage rates trended down, as new data indicates that inflationary pressures are receding,” said Sam Khater, Freddie Mac’s Chief Economist. “The combination of continued economic strength, lower inflation and lower mortgage rates should likely bring more potential homebuyers into the market.”

- 30-year fixed-rate mortgage averaged 7.44 percent as of November 16, 2023, down from last week when it averaged 7.5 percent. A year ago at this time, the 30-year FRM averaged 6.61 percent.

- 15-year fixed-rate mortgage averaged 6.76 percent, down from last week when it averaged 6.81 percent. A year ago at this time, the 15-year FRM averaged 5.98 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

NAR Deputy Chief Economist Jessica Lautz had this to say about today’s mortgage interest rate news.

Mortgage interest rates are showing signs of relief for home buyers. They have now dropped to 7.44% from 7.5% the week prior. The three-week drop is a steady sign we likely have hit a peak and are headed south for mortgage rates, especially as the 10-year treasury continues its fall from a peak of 5% to 4.4% today.

Late fall and early winter are typically slower home sales months, as home buyers generally do not want to uproot their family in the middle of the school year, and shopping for a home in the snow may not be an attractive option. However, as rates continue the expected decline, this might be a calmer season to home shop before rates fall into the 6% range in spring and pent-up demand floods into the market.

For now, as Pitbull says, “It’s going down, I’m yelling Timber.”

Dr. Jessica Lautz is the Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link