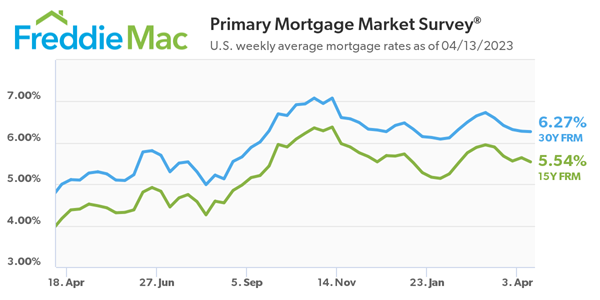

Freddie Mac (OTCQB: FMCC) released its Primary Mortgage Market Survey® (PMMS®) today (04/13/2023), revealing that the 30-year fixed-rate mortgage (FRM) averaged 6.27 percent as of April 13, 2023. This marks the fifth consecutive week of declining mortgage rates, providing a glimmer of hope for prospective homebuyers as the housing market heads into its peak season in the spring and summer.

Sam Khater, Chief Economist at Freddie Mac, commented on the trend, stating, “Mortgage rates decreased for the fifth consecutive week. Incoming data suggest inflation remains well above the desired level but showing signs of deceleration. These trends, coupled with tight labor markets, are creating increased optimism among prospective homebuyers as the housing market hits its peak in the spring and summer.”

Compared to the previous week, the 30-year FRM dropped slightly from 6.28 percent to 6.27 percent. However, when compared to the same time last year, the rates have increased significantly, with the 30-year FRM averaging 5.00 percent in April 2022.

In addition to the 30-year FRM, the 15-year fixed-rate mortgage also experienced a decrease in rates. It averaged 5.54 percent, down from 5.64 percent the previous week. A year ago, the 15-year FRM averaged 4.17 percent.

The PMMS® focuses on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit. Despite the recent decrease in rates, it’s important to note that mortgage rates can vary depending on individual financial situations and market conditions.

The declining mortgage rates come amid concerns about inflation, which has been running above desired levels. However, recent data suggests that inflation may be showing signs of slowing down, which could be contributing to the decrease in mortgage rates. Tight labor markets are also playing a role in boosting optimism among prospective homebuyers, as a strong job market can provide stability and confidence in making a home purchase.

As the housing market heads into its peak season in the spring and summer, the decrease in mortgage rates may provide some relief for prospective homebuyers who have been grappling with rising home prices and limited inventory. However, it remains to be seen how the housing market will evolve in the coming months, and whether the trend of declining mortgage rates will continue. Prospective homebuyers are encouraged to closely monitor market conditions and work with trusted professionals to make informed decisions about their home purchase.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link