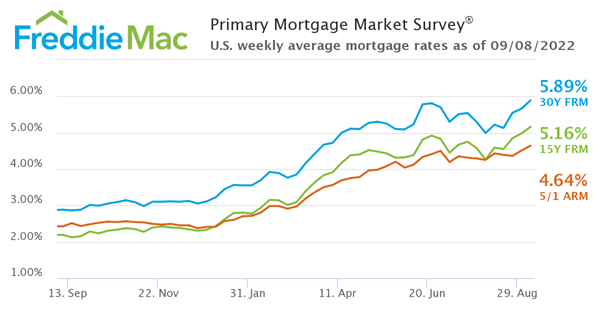

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS® ) ending 09/08/2022, showing that the 30-year fixed-rate mortgage (FRM) averaged 5.89 percent.

“Mortgage rates rose again as markets continue to manage the prospect of more aggressive monetary policy due to elevated inflation,” said Sam Khater, Freddie Mac’s Chief Economist. “Not only are mortgage rates rising but the dispersion of rates has increased, suggesting that borrowers can meaningfully benefit from shopping around for a better rate. Our research indicates that borrowers could save an average of $1,500 over the life of a loan by getting one additional rate quote and an average of about $3,000 if they get five quotes.”

- 30-year fixed-rate mortgage averaged 5.89 percent with an average 0.7 point as of September 8, 2022, up from last week when it averaged 5.66 percent. A year ago at this time, the 30-year FRM averaged 2.88 percent.

- 15-year fixed-rate mortgage averaged 5.16 percent with an average 0.8 point, up from last week when it averaged 4.98 percent. A year ago at this time, the 15-year FRM averaged 2.19 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.64 percent with an average 0.4 point, up from last week when it averaged 4.51 percent. A year ago at this time, the 5-year ARM averaged 2.42 percent.

Fr daily mortgage interest rate movements, check with your mortgage lender. You may also find rate information on sites such as Mortgage News Daily.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link