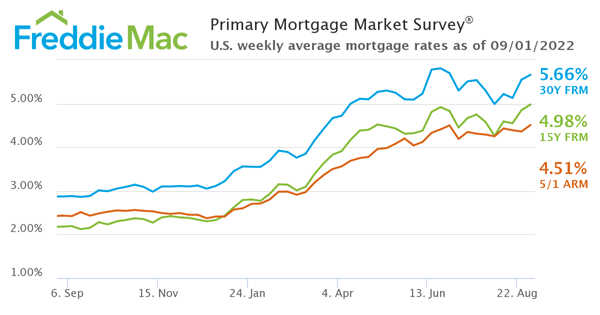

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey (PMMS), showing that the 30-year fixed-rate mortgage (FRM) averaged 5.66 percent.

“The market’s renewed perception of a more aggressive monetary policy stance has driven mortgage rates up to almost double what they were a year ago,” said Sam Khater, Freddie Mac’s Chief Economist. “The increase in mortgage rates is coming at a particularly vulnerable time for the housing market as sellers are recalibrating their pricing due to lower purchase demand, likely resulting in continued price growth deceleration.”

- 30-year fixed-rate mortgage averaged 5.66 percent with an average 0.8 point as of September 1, 2022, up from last week when it averaged 5.55 percent. A year ago at this time, the 30-year FRM averaged 2.87 percent.

- 15-year fixed-rate mortgage averaged 4.98 percent with an average 0.8 point, up from last week when it averaged 4.85 percent. A year ago at this time, the 15-year FRM averaged 2.18 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.51 percent with an average 0.4 point, up from last week when it averaged 4.36 percent. A year ago at this time, the 5-year ARM averaged 2.43 percent.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link