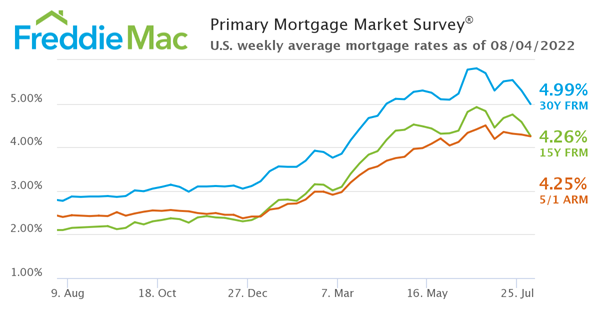

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®) for the week ending August 4th, showing that the 30-year fixed-rate mortgage (FRM) averaged 4.99 percent.

“Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth,” said Sam Khater, Freddie Mac’s Chief Economist. “The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, especially as the Federal Reserve attempts to navigate the current economic environment.”

- 30-year fixed-rate mortgage averaged 4.99 percent with an average 0.8 point as of August 4, 2022, down from last week when it averaged 5.30 percent. A year ago at this time, the 30-year FRM averaged 2.77 percent.

- 15-year fixed-rate mortgage averaged 4.26 percent with an average 0.6 point, down from last week when it averaged 4.58 percent. A year ago at this time, the 15-year FRM averaged 2.10 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.25 percent with an average 0.3 point, down from last week when it averaged 4.29 percent. A year ago at this time, the 5-year ARM averaged 2.40 percent.

For information on daily interest rate movements, check with your mortgage lender. You may also find daily mortgage interest rate information online on sites such as Mortgage News Daily.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link